In today’s fast-paced world, financial independence is a growing priority for many, How To use dividend stocks for passive income and more people are looking for reliable ways to build wealth that doesn’t require constant, active work. Among the numerous options available, one proven method stands out: investing in dividend stocks.

Dividend stocks may not have the high-risk, high-reward allure of tech or growth stocks, but their stability and consistent returns make them a staple in any well-balanced investment portfolio. This article will delve into how you can use dividend stocks to build a passive income stream, why they are a smart choice, and how to craft a portfolio that aligns with your financial aspirations.

Dividend stocks can provide a steady source of passive income. They pay a portion of the company’s profits to shareholders regularly. This can be an easy way to grow wealth over time without selling shares.

How To use dividend stocks for passive income, start by choosing reliable companies with a history of paying dividends. Reinvesting these dividends can help grow your wealth. Over time, this can lead to a larger, more dependable income source.

For those interested in long-term financial planning, this strategy can be a powerful part of a broader approach to wealth building. You might also want to consider how to build a solid financial future for more tips on securing your finances.

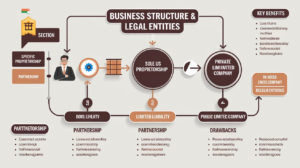

What Are Dividend Stocks For Passive Income and Why Are They Important?

Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders in the form of dividends, typically on a quarterly basis. These payments provide a predictable and stable stream of income to investors. This dual nature—capital appreciation (the potential for the stock price to increase) and regular income (through dividends)—makes them a valuable asset for investors who seek to build both long-term wealth and short-term income.

The companies that typically pay dividends are large, well-established firms with a long history of profitability. Companies like Johnson & Johnson, Procter & Gamble, and Coca-Cola are excellent examples of reliable dividend payers. These businesses often operate in industries that tend to remain stable during economic turbulence, such as consumer staples, healthcare, and utilities.

Dividend stocks offer a unique combination of steady income and growth potential. They are especially valuable for investors who are risk-averse and prefer to avoid the volatility that comes with high-growth stocks. If you are someone who appreciates financial stability over chasing big returns, this approach can be key to achieving your financial goals.

Additionally, for anyone considering different avenues of entrepreneurship or investment, exploring small business ideas for 2024 can provide an excellent complement to your financial strategy.

The Appeal of How To Use Dividend Stocks For Passive Income from Dividends

What could be more appealing than earning money while you sleep? For many investors, dividend stocks offer a way to make that a reality. Whether you’re saving for retirement, a major purchase, or simply want to enjoy financial freedom, dividends can provide a reliable, relatively low-effort method to enhance your financial situation.

Let’s break it down: if you invest $100,000 in a dividend-paying stock portfolio that offers an average yield of 4%, you could generate $4,000 annually in passive income. This income is generated without selling your stocks, allowing you to retain ownership and benefit from both dividends and potential stock appreciation. Better yet, if you reinvest those dividends, you can increase the compounding effect, significantly growing your income and wealth over time.

Reinvesting dividends is one of the most powerful methods to accelerate wealth accumulation. It’s a simple concept—by using the dividends you earn to purchase additional shares, you enhance your future dividend income and potential for capital gains. This snowball effect can lead to exponential growth, especially over longer time horizons.

If you’re already thinking of other ways to build passive income alongside investing in stocks, check out how to start a small online business from home for ideas that could fit into your overall financial plan.

Why Dividend Stocks Are Considered Safe Investments

Dividend stocks are often perceived as safer investments compared to high-growth stocks. How To Use Dividend Stocks For Passive Income. The reason for this is that companies paying dividends are usually financially sound businesses with steady earnings. These companies often prioritize rewarding shareholders through dividends because they have established themselves in their industries and don’t need to reinvest all their profits for growth.

Moreover, dividend-paying companies tend to be more resilient in the face of economic downturns. A study conducted by Hartford Funds in 2023 found that companies consistently paying and increasing dividends outperformed the broader market during times of volatility. For investors looking for steady income, especially during uncertain times, How To Use Dividend Stocks For Passive Income dividend stocks are a natural choice.

Additionally, some companies fall under the category of “Dividend Aristocrats”—these are firms that have paid and increased dividends annually for at least 25 consecutive years. This level of consistency often signals strong financial health, making these companies attractive for conservative investors who value safety and stability over high-risk, high-reward opportunities.

For anyone interested in building a business alongside their dividend stock investments, small business ideas for women can offer a roadmap to entrepreneurial success while enjoying the steady returns from dividend stocks.

Building a Dividend-Focused Portfolio How To Use Dividend Stocks For Passive Income

Building a portfolio focused on dividends requires more than just picking the stocks with the highest yields. How To Use Dividend Stocks For Passive Income. The goal is to strike a balance between yield, consistency, and potential for growth. Here are some essential strategies for creating a dividend-focused portfolio:

1. Don’t Chase High Yields

It’s tempting to go for stocks with the highest dividend yields, but this can sometimes be a trap. A stock may have a high yield because its price has fallen dramatically, often signaling financial trouble. Instead, look for companies with moderate yields (2%-5%) that have a strong history of dividend payments and increases.

2. Diversify Across Sectors

While it’s true that industries like utilities and consumer staples are known for dividend payouts, it’s crucial to diversify your portfolio across different sectors. This reduces your risk if one sector experiences a downturn. Consider adding dividend-paying stocks from sectors such as healthcare, financials, or technology. This way, you protect your income stream from sector-specific economic shocks.

3. Reinvest Dividends

Reinvesting dividends is one of the most effective ways to grow your portfolio over time. Many brokerage firms offer dividend reinvestment plans (DRIPs), allowing you to automatically reinvest your dividends into additional shares of the same stock. This boosts both your stock holdings and your future dividend income.

4. Focus on Dividend Growth Stocks

Some stocks may offer higher initial yields, but the smartest approach is often to focus on companies that consistently increase their dividends. “Dividend growth” stocks provide both capital appreciation and an ever-growing income stream. Over time, this can significantly boost your overall returns.

By following these steps, you can build a portfolio that generates reliable, growing income over time.

For more in-depth advice on turning business ideas into financial reality, especially alongside dividend investing, check out from idea to reality: how to start a cosmetic business from scratch for entrepreneurial insights.

The Tax Implications of Dividend Income

Before diving deep into dividend investing, it’s crucial to understand How To Use Dividend Stocks For Passive Income are taxed. In the United States, dividends are classified as either “qualified” or “non-qualified.”

- Qualified dividends are taxed at a lower rate, the same as long-term capital gains (0%, 15%, or 20%, depending on your income).

- Non-qualified dividends are taxed at your ordinary income tax rate, which can be as high as 37%.

To maximize tax efficiency, consider holding dividend-paying stocks in tax-advantaged accounts like IRAs or 401(k)s, where dividends can grow tax-free or tax-deferred.

If you’re exploring other business opportunities alongside investing, social business and trends may provide useful insights on how social responsibility and profit can coexist in today’s business environment.

The Importance of Patience and Long-Term Thinking

Dividend investing is not a get-rich-quick strategy. It requires a long-term perspective and patience. Market volatility can cause fluctuations in stock prices, but as long as the underlying companies remain strong, the dividend payouts tend to be stable.

The real power of dividend investing comes from the compounding effect over time. How To Use Dividend Stocks For Passive Income. As you reinvest your dividends, you increase your shareholdings, which in turn increases your dividend income. The key is to remain patient and disciplined, even during market downturns. Over time, you’ll see how the slow and steady nature of dividend investing builds substantial wealth.

Conclusion: Dividend Stocks as a Tool for Passive Income

Dividend investing is a time-tested strategy for generating How To Use Dividend Stocks For Passive Income and building long-term wealth. By focusing on financially strong companies with a history of dividend payments, diversifying your portfolio, and reinvesting dividends, you can create a reliable, growing income stream.

While dividend investing requires patience, the rewards can be significant. It’s an approach that can provide a lifetime of financial security, whether you’re a retiree looking for additional income or a young investor just starting your wealth-building journey. Combining dividend investing with entrepreneurship, as discussed in how to build a solid financial future and small business ideas for 2024, can further enhance your financial success.

FAQs: How to Use Dividend Stocks for Passive Income

How do dividend stocks provide passive income?

Dividend stocks generate passive income by paying out a portion of a company’s earnings to shareholders. These payments, called dividends, are typically distributed quarterly and provide a steady source of income without having to sell your shares.

What is the difference between qualified and non-qualified dividends?

Qualified dividends are taxed at a lower capital gains rate, while non-qualified dividends are taxed as ordinary income. Understanding the difference is crucial for tax planning.

Can I reinvest dividends to increase my returns?

Yes, reinvesting dividends can accelerate your returns over time through the power of compounding. Many brokerages offer automatic reinvestment programs that make this process easy.

How do I pick the best dividend stocks?

Look for companies with a consistent history of paying and increasing dividends. It’s also important to consider the company’s financial stability and diversify your investments across various sectors.

Are dividend stocks safe during market downturns?

Dividend-paying companies, especially Dividend Aristocrats, tend to be more stable during market downturns. They often continue paying dividends even in tough economic times, providing investors with steady income.