Introduction

A “legal business” is any business operation that adheres to the laws and regulations of a specific country or region. Legal businesses include everything from large corporations to small local shops, but what they share in common is a commitment to operating within the legal boundaries set by the goverment authorities. These laws cover various aspects such as registration, taxation, employment practices, consumer protection, and ethical operations. This distinction is critical in the business world, as legality builds a solid foundation for growth, credibility, and customer trust.

Operating within the legal framework allows businesses to avoid unnecessary risks, including hefty fines and potential closure, while promoting sustainable development. Legal compliance, therefore, is more than just avoiding penalties—it’s about building a trustworthy brand and a sustainable business that can weather market changes and regulatory updates.

What Constitutes a Legal Business?

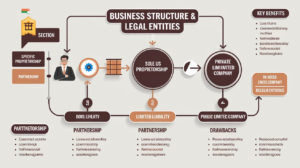

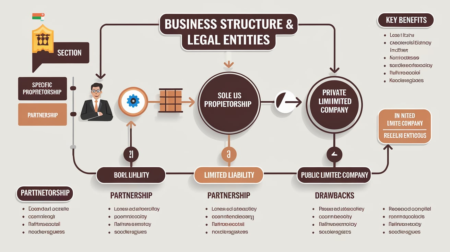

A legal business is fundamentally defined by its attachment to the laws and regulations set by the governing bodies within its operating jurisdiction. This involves proper registration with local or national authorities, ensuring that the business has a unique legal identity and exists transparently. Registration often includes steps like obtaining a business license, choosing a legal structure (such as a sole proprietorship, partnership, or corporation), and securing any industry-specific permits. By fulfilling these legal formalities, the business gains the right to operate and is publicly recognized as a legalized enterprise.

Beyond registration, a legal business must follow specific obligations, such as tax registration, filing regular tax returns, and complying with employment and labor laws. A legal business, therefore, is not just about obtaining licenses but also about maintaining continual compliance with all legal requirements that govern operations, employee welfare, and customer safety. By meeting these obligations, businesses demonstrate their commitment to responsible and transparent practices, building a solid foundation for long-term growth and credibility in the marketplace.

A legal business is one that has completed necessary registration, licensing, and tax obligations with the government. Being legally recognized means a business has secured the right to operate and trade in a legitimate, authorized manner. Here’s a breakdown of the essential components:

Business Registration and Licensing

Business registration is the first step for any legal enterprise. This involves submitting information about the business to government authorities, which may include details like the name, business structure (e.g., sole proprietorship, partnership, or corporation), and the nature of the business. This process is essential for transparency, and it protects both the business and its consumers.

- Example: Registering a coffee shop in the U.S. might involve obtaining a business license, a health department permit (for food safety), and possibly even local permits if live music or outdoor seating is offered. Each of these licenses is required to meet specific regulatory standards and to protect public interest.

Tax Registration and Compliance

Legally operating businesses are required to register for a tax identification number and follow through with tax filing obligations. Tax registration and compliance are crucial steps, as they contribute to public funds used for infrastructure, healthcare, and education.

- Example: In countries with VAT (Value Added Tax), businesses are also required to collect and remit taxes on goods or services. Regular tax payments demonstrate a business’s commitment to social responsibility and help avoid penalties or audits.

Importance of Compliance

Legal compliance extends to other aspects like employment practices, environmental standards, and intellectual property rights. By fulfilling these legal obligations, businesses show commitment to operating responsibly. It also minimizes the risk of legal disputes and enhances the business’s public image.

- Example: In industries like construction, compliance might include meeting safety standards and obtaining building permits. Failure to adhere to such standards could result in fines, project delays, or worse—legal consequences if an accident occurs due to non-compliance.

Key Characteristics of a Legal Business

Legal businesses are characterized by their ethical and responsible conduct in all aspects of their operations. This includes respecting the rights of customers, fair treatment of employees, and transparency with suppliers and partners. Ethical practices are central to these businesses, covering areas such as fair advertising, responsible financial reporting, and attachment to fair competition laws. These attributes not only ensure compliance but also help build trust, enhance the business’s reputation, and reduce the risk of legal disputes with various stakeholders.

Another important quality is following tax and labor laws, which are essential for running a business legally. attributes to tax laws involves timely filings, accurate record-keeping, and remitting taxes owed, which help avoid penalties. Meanwhile, compliance with labor laws ensures fair wages, safe working environments, and equal opportunity, creating a positive workplace culture. Through these practices, legal businesses establish themselves as trustworthy and reliable, attracting both customers and skilled employees, while positioning themselves favorably in their industry.

Operating a business legally involves several characteristics, each of which promotes a fair, safe, and ethical environment for employees, customers, and partners. Here are the core traits of a legally compliant business:

- Ethical Business Practices

Ethical business practices involve making decisions that respect the rights and interests of others. This includes fair advertising, honest communication, and treating all stakeholders fairly. By maintaining ethical standards, businesses create a positive reputation and often enjoy greater customer loyalty.

- Example: A clothing brand that is transparent about its supply chain and actively avoids child labor or exploitation in its manufacturing processes sets an ethical standard that resonates with consumers and helps it build trust in its brand.

- Adherence to Labor Laws

Labor laws protect the rights of employees, covering areas like minimum wage, safe working conditions, and protection against discrimination. Adhering to these laws creates a positive work environment, reduces turnover, and enhances productivity.

- Example: In many regions, companies must provide benefits like paid leave, sick days, and parental leave. Not only do these practices support employee welfare, but they also create a respectful and equitable workplace culture that aligns with legal standards.

- Tax Compliance

Tax compliance involves timely filing and paying taxes, as well as maintaining accurate financial records. This ensures that the business remains in good standing with tax authorities and avoids financial penalties.

- Example: A business that operates in multiple states or countries must understand each jurisdiction’s tax laws and comply with them to avoid legal complications and reputational damage.

These characteristics not only make a business compliant but also build a reputation of reliability and trustworthiness, making it more attractive to consumers, partners, and investors alike.

Why Legal Business Practices Matter

Legal business practices are essential not only for preventing legal remoteness but also for building a well respected brand that customers, employees, and partners can trust. By operating legally, businesses avoid penalties, lawsuits, and other risks that could otherwise damage their reputation and financial stability. This helps create a solid foundation for growth, as legal businesses can focus their resources on innovation and improvement rather than costly legal battles or damage control. In addition, being a compliant business fosters positive relationships with regulators and enhances community support.

Furthermore, legal practices are important because they enhance customer trust and loyalty, which are vital in today’s competitive market. Consumers are increasingly looking for brands that align with ethical values and operate transparently. By following fair advertising, consumer protection laws, and ethical sourcing practices, businesses can cultivate strong brand loyalty. This loyalty translates into sustained revenue, greater market share, and a loyal customer base that advocates for the brand, all of which contribute to a business’s long-term success.

Operating legally goes beyond just following rules; it offers significant advantages in terms of trust, risk management, and growth potential. Here are some key benefits of legal business practices:

- Building Brand Trust

Legally compliant businesses gain the trust of customers, who feel more secure knowing they are dealing with a responsible and ethical entity. Trust is invaluable and can be a key differentiator in competitive markets.- Example: Many consumers prefer to buy from brands that align with their ethical values, such as fair trade, cruelty-free, or environmentally friendly brands. By aligning operations with ethical and legal standards, companies build loyalty and a positive reputation.

- Avoiding Penalties and Lawsuits

Non-compliance with regulations can lead to fines, lawsuits, and even business closure. Companies that prioritize compliance avoid these costly disruptions, ensuring a smoother path to growth and stability.- Example: A business in the food industry that disregards health regulations risks severe penalties if customers suffer from foodborne illnesses due to poor hygiene practices. Not only could this result in lawsuits, but it could also damage the business’s reputation irreparably.

- Ensuring Long-Term Success

Legal compliance lays the groundwork for sustainable success. Businesses that comply with laws are better positioned to adapt to market changes, meet customer expectations, and handle economic downturns. They also create a framework that supports steady growth.- Example: A technology company that respects intellectual property rights is better positioned for partnerships, as other businesses are more likely to collaborate with companies they know will respect legal boundaries.

On the flip side, businesses that ignore legal requirements may experience regulatory action, loss of customer trust, and an uncertain future.

Common Legal Requirements for Businesses

Most businesses must meet a range of legal requirements to operate within their industry and region. These typically begin with registration and obtaining the necessary licenses and permits that align with their business activities. For example, food establishments may need health permits, while businesses in finance may require regulatory approval. Additionally, businesses often need a tax identification number and are required to file regular tax returns to report income and pay taxes owed, ensuring they remain in good standing with tax authorities.

Labor laws and employee rights are also common legal requirements, mandating that businesses provide safe working environments, fair wages, and benefits. Many jurisdictions require businesses to follow employment contracts, provide workers with adequate training, and ensure that the workplace is free from discrimination or harassment. Depending on the industry, some businesses may also need to meet industry-specific standards, such as environmental regulations for manufacturing or patient privacy laws in healthcare. Compliance with these legal standards builds a robust framework for fair operations and reduces the likelihood of facing legal challenges.

Legal requirements vary depending on location, industry, and business structure, but some obligations are common across most businesses. Here are the standard requirements most businesses must meet:

- Obtaining Permits and Licenses

To operate legally, most businesses must obtain specific permits or licenses. These vary widely, depending on the industry, and ensure that the business meets regulatory standards for safety, environmental protection, and public health.- Example: A restaurant may need a food handler’s permit, a liquor license, and regular health inspections to comply with public health standards.

- Tax Registration and Reporting Obligations

Businesses are generally required to register with tax authorities, collect necessary taxes on goods or services, and submit regular tax filings.- Example: A U.S.-based business must register for an Employer Identification Number (EIN) and regularly submit income and payroll taxes to the IRS.

- Employee Rights and Safety Standards

Labor laws exist to ensure that employees are treated fairly and work in safe conditions. Non-compliance with these laws can lead to lawsuits, fines, and damage to the company’s reputation.- Example: In construction, specific safety regulations must be followed, such as providing protective gear to employees. Failure to meet these standards can lead to serious penalties and even criminal charges if workers are injured due to non-compliance.

These requirements are foundational to running a legal business and can vary significantly by industry. For instance, healthcare providers must comply with patient confidentiality laws, while manufacturing businesses may need to meet environmental standards.

Challenges and Solutions in Running a Legal Business

One of the major challenges in maintaining a legal business is staying updated with evolving regulations, which can vary by industry and location. Changes in tax laws, employment standards, or safety regulations can require businesses to adapt quickly to stay compliant. For smaller businesses, this can be particularly challenging due to limited resources. Solutions to these challenges include consulting with legal or regulatory experts who can provide guidance and subscribing to industry publications or government updates to stay informed of regulatory changes.

Another common challenge is the cost of compliance, as maintaining a legally sound business often involves expenses for permits, employee training, record-keeping, and possibly legal consultations. For startups or smaller businesses, these costs can add up quickly. One solution is to allocate a dedicated compliance budget and invest in compliance software that simplifies tracking and record-keeping. This not only ensures efficient compliance but also helps businesses allocate resources more strategically, reducing the burden of compliance costs while safeguarding their legal standing.

Maintaining a business’s legal status is not without its challenges, particularly as laws evolve. Here are some of the common challenges and ways to address them:

Navigating Regulatory Changes

Laws and regulations change over time, and businesses need to stay updated to remain compliant. This can be particularly challenging for small businesses with limited resources.

Solution: Subscribing to industry publications or government updates can help businesses keep track of regulatory changes. Hiring a legal consultant can also be beneficial, as they can interpret and implement new laws effectively.

Understanding Complex Regulations

Some industries are heavily regulated, making it challenging for businesses to navigate the complexity of the laws.

Solution: Consulting with legal experts who specialize in the industry can simplify compliance. Additionally, businesses can invest in compliance software that tracks and monitors regulatory requirements.

By proactively addressing these challenges, businesses can maintain their legal status and reduce the risk of unintentional non-compliance.

Conclusion

Legal business practices form the foundation for trust, sustainability, and long-term growth. By meeting registration requirements, following ethical practices, adhering to tax laws, and keeping up with industry-specific regulations, businesses can operate responsibly and gain a competitive edge.

Whether you’re an entrepreneur or a business professional, ensuring legal compliance is essential for building a successful enterprise. The benefits of legal compliance are clear: greater credibility, customer loyalty, and a resilient brand capable of thriving in today’s complex and competitive market.

2 Comments

Pingback: Legal Business – Definition, Importance, and Types - Urban Vibe Mag

Pingback: Business Structures and Legal Entities in India: An In-Depth Guide - Urban Vibe Mag